Changing your bank account information can be confusing, especially when it comes to important payments like social grants. If you need to update your details, this guide will walk you through the SASSA change banking details process step-by-step, helping you manage your SASSA Banking Details correctly to ensure your grant payments continue without interruption. Whether you want to do it online or in person, we’ll cover everything you need to know to ensure your grant payments continue without interruption.

Why You Might Need to Change Your SASSA Banking Details

Keeping your banking information up to date with SASSA is essential to avoid delays or problems with your grant payments. Regularly reviewing and updating your SASSA Banking Details ensures that your grants are deposited safely and on time. There are several common reasons why beneficiaries consider a SASSA change banking details request. Let’s look at some of them:

1. You Changed Your Bank Account

If you’ve recently closed your old account or switched to a new bank, SASSA will not be able to deposit your grant into the new account unless you update your information. You must change your banking details to avoid failed or bounced payments.

2. You Lost Access to Your Bank Account

Some people may lose access to their accounts due to forgotten login details, card theft, or other technical problems. If you can’t access your bank account anymore, it’s important to submit a SASSA change banking details request with a valid and accessible account.

3. You’re Concerned About Fraud or Security

If you suspect someone has access to your old account or your details were compromised in any way, you should act fast and change your banking details with SASSA. This helps protect your grant money from being stolen or misused.

4. You Got a Better Bank Option

Many beneficiaries move to banks that offer lower fees, faster payments, or better mobile services. For example, some people prefer banks like Capitec or TymeBank because of user-friendly apps and low costs. If this applies to you, submit a SASSA change banking details request to link the new account.

5. Your Old Bank Account Was in Someone Else’s Name

SASSA only allows payments to bank accounts registered in the beneficiary’s name. If you used a family member’s or friend’s account in the past, you’ll need to open your own account and change your banking details to receive payments directly.

What You Need Before You Can Change Banking Details

Before you start the SASSA change banking details process, it’s important to gather the correct documents and information. This ensures a smooth update and avoids delays in your grant payments. Here’s what you’ll need:

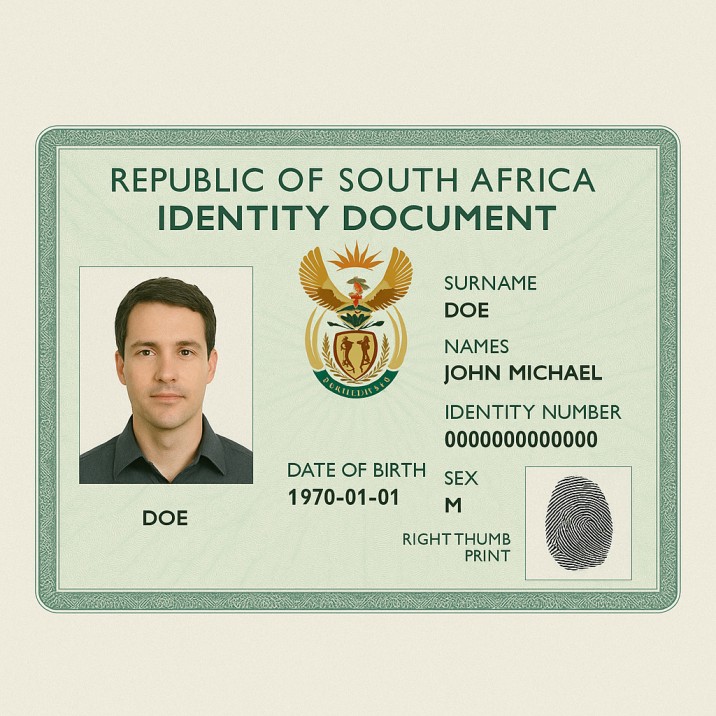

1. South African ID Document

You must have your green barcoded ID book, smart ID card, or valid Temporary Identity Certificate. This proves that you are the rightful SASSA beneficiary.

2. Proof of Bank Account

SASSA needs to see that the bank account you are submitting is registered in your name. You can use:

- A recent bank statement (not older than 3 months), or

- An official bank confirmation letter

Make sure your full name, account number, and branch code are clearly visible.

3. Mobile Phone Number Registered in Your Name

If you’re applying online, you’ll receive a secure link via SMS. Make sure the mobile number SASSA has on file is active and registered in your name. If your number has changed, update it before trying to change banking details.

4. SASSA Grant Reference or Card

Although not always required online, it’s a good idea to have your SASSA card or grant number ready in case you need to verify your account during the update process.

5. Internet Access (For Online Applications)

If you’re updating your banking details via the SASSA SRD website, make sure you have:

- A reliable internet connection

- A smartphone or computer

- Time to complete the process in one sitting

How to Change SASSA Banking Details Online

If you’re a SASSA grant recipient and need to update your bank account, the easiest way to do it is online. The official SASSA change banking details process can be completed in just a few steps using your smartphone or computer. Here’s how to do it safely and correctly.

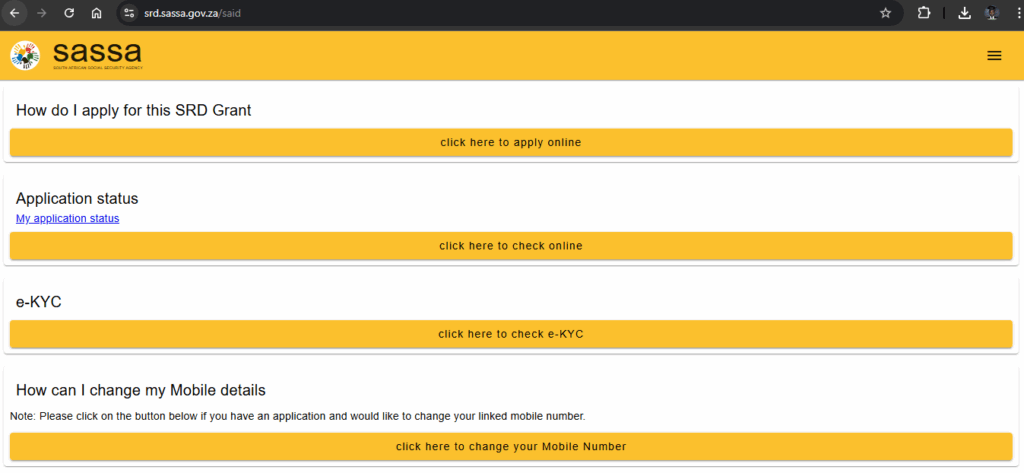

Step 1: Visit the Official SASSA SRD Website

Go to: https://srd.sassa.gov.za

This is the only official site for SRD (Social Relief of Distress) grants. Be careful of fake websites or scams.

Step 2: Scroll to “How do I change my banking details?”

Find the section titled “How do I change my banking details?” on the homepage. It’s usually near the middle of the page.

Step 3: Enter Your ID Number

You’ll be asked to enter your South African ID number. This helps the system find your grant application.

Step 4: Wait for the SMS with a Secure Link

SASSA will send a unique link to the cellphone number you used during your original application. Click the link to continue the process.

Note: If your cellphone number has changed, you’ll need to update that first.

Step 5: Fill In Your New Banking Details

Once inside the secure link, you’ll be able to enter your:

- Bank name

- Account type (savings or cheque)

- Account number

- Branch code

Make sure all information is correct and that the account belongs to you.

Step 6: Submit and Wait for Verification

After you submit, SASSA will verify your new banking details with your bank. This process usually takes 7 to 10 working days. You will receive confirmation via SMS once it’s approved.

Important Reminders:

- Only use your own bank account. SASSA does not allow third-party accounts.

- Make sure your bank statement or bank confirmation letter is valid and shows your name clearly.

- Do not share the secure SMS link with anyone.

How to Change SASSA Banking Details In-Person

If you’re unable to change your banking details online or don’t have internet access, you can still complete the SASSA change banking details process by visiting a local SASSA office or designated Post Office. This method is useful for people who prefer face-to-face help or who receive payments through the SASSA Gold Card.

Step 1: Gather the Required Documents

Before heading to a SASSA office, make sure you have the following:

- Your original South African ID document or smart ID card

- Your SASSA card or grant number

- A recent bank statement or bank confirmation letter (not older than 3 months)

- A working mobile phone number registered in your name

Step 2: Visit Your Nearest SASSA Office or Post Office

Go to your nearest SASSA regional office or, if you receive grants through a SASSA Gold Card, visit a Post Office that handles grant-related queries.

Step 3: Ask for the Banking Details Update Form

Request the official form to update your banking details. Fill it out carefully and make sure the information matches what’s on your documents.

Step 4: Submit Your Form and Documents

Hand in the completed form along with your supporting documents. A SASSA official will verify your details and confirm that the account is in your name.

Step 5: Wait for Confirmation

Once submitted, your new banking information will go through a verification process. This can take 7 to 10 working days. You will receive an SMS once your details are approved and your grant will be paid into the new account from the next cycle.

Tips for In-Person Applications

- Go early to avoid long queues

- Carry a pen and copies of your documents just in case

- Don’t forget your cellphone — you may need it for SMS verification

How Long Does It Take for the New Banking Details to Be Updated?

Once you’ve submitted a SASSA change banking details request, your new information won’t reflect immediately. SASSA first needs to verify your identity and confirm that the bank account belongs to you before switching payments to the new account.

Average Processing Time: 7 to 10 Working Days

SASSA usually takes 7 to 10 working days (excluding weekends and public holidays) to verify and update your banking details. During this time, SASSA communicates with your bank to confirm that the account:

- Exists

- Belongs to you (must match your ID)

- Is active and ready to receive payments

What Can Delay the Process?

Your update may take longer if:

- You submitted incorrect or mismatched details

- The bank statement is outdated or unclear

- The ID number doesn’t match the account holder name

- The bank verification process fails

How to Check the Status of Your Update

You can check if your SASSA change banking details request has been processed by:

- Visiting the SASSA SRD status page

- Looking out for SMS updates from SASSA

- Calling the SASSA helpline at 0800 60 10 11

How to Know If Your SASSA Banking Details Were Successfully Changed

After submitting a SASSA change banking details request, it’s important to confirm whether your new banking information was accepted and processed. This helps you avoid missed payments or having your grant sent to the wrong account.

Here are the easiest ways to check if your SASSA banking details have been successfully updated:

1. Check for an SMS Notification

SASSA will send you a confirmation SMS once your new banking details have been verified and approved. This message usually confirms that your next payment will go into the new account.

2. Use the SASSA SRD Status Check Tool

You can track the status of your application or banking details online:

- Go to https://srd.sassa.gov.za/sc19/status

- Enter your South African ID number and phone number

- Click “Submit” to view your current application and payment status

If your new bank name or account number appears, that means your SASSA change banking details request was successful.

3. Monitor Your Bank Account

If your payment date has passed, check your bank account to see if funds were deposited into your new account. If you received the grant, your update was successful.

4. Call the SASSA Helpline

If you’re unsure or didn’t receive any confirmation, you can contact SASSA directly:

- Call: 0800 60 10 11

- Hours: Monday to Friday, 08:00 to 16:00

- Have your ID number ready when calling

Final Tip:

Always make sure the mobile number you used to apply is active. If that number is no longer working, update it first before making changes to your banking information.

By using the tools and tips above, you can easily confirm whether your SASSA change banking details request was successful — and enjoy uninterrupted grant payments.

Common Mistakes to Avoid When Changing SASSA Banking Details

Updating your bank account for SASSA payments may seem easy, but small errors can delay your grant or cause it to be rejected. To avoid problems during the SASSA change banking details process, watch out for these common mistakes.

1. Using Someone Else’s Bank Account

Your bank account must be registered in your own name. SASSA will reject updates if the account belongs to a family member, partner, or friend. This is a strict rule to prevent fraud.

2. Submitting Outdated Bank Statements

You must upload or submit a recent bank statement or bank confirmation letter, not older than 3 months. Old documents can delay verification or lead to rejection.

3. Entering the Wrong Account Number or Branch Code

One small typing error in your account number or branch code can result in failed payments. Always double-check your details before submitting.

4. Using a Closed or Dormant Account

Make sure your account is still active and able to receive deposits. If the account is closed, SASSA will not be able to process your grant payment.

5. Ignoring SMS Verification

After starting the SASSA change banking details process online, SASSA sends a secure SMS link to your registered number. Ignoring or delaying this step will stop the process. Complete it as soon as you receive the message.

6. Not Updating Your Mobile Number First

If your cellphone number has changed and you haven’t updated it, you won’t receive the verification SMS. Make sure your number is up to date before trying to change your bank details.

7. Falling for Scams or Using Fake Websites

Never share your banking info or ID with strangers. Only use the official SASSA SRD website:

https://srd.sassa.gov.za

Final Advice:

Before you submit a SASSA change banking details request, review everything twice. Make sure your name matches your bank account and your documents are clear and valid. This will help you avoid delays and ensure your grant arrives on time.

Can You Change SASSA Banking Details More Than Once?

Yes, you can change your SASSA banking details more than once, but there are a few important rules and limitations you should know. Repeated changes may affect your payment timing, so it’s best to be sure before submitting new details.

How Often Can You Change Banking Details?

SASSA allows beneficiaries to submit a SASSA change banking details request once per payment cycle. This means:

- You can change your bank account again only after the previous request has been verified and approved.

- Frequent changes can slow down the verification process and may delay your payments.

Why You Might Change More Than Once

You might need to update your banking details more than once if:

- You closed your newly submitted account after your first change

- You found a better or more affordable bank

- Your account was flagged for fraud or technical issues

- The first update failed due to incorrect information

What to Keep in Mind

- Wait for confirmation before submitting another change

- Ensure all the new details are correct and match your ID

- Repeated changes may delay your next payment, especially if verification takes longer

Where to Submit a New Update

If you’re ready to make another change:

- Go to https://srd.sassa.gov.za

- Follow the same secure process for banking detail updates

- Use your ID number and wait for the SMS link

Final Tip:

While it’s possible to submit more than one SASSA change banking details request, it’s best to choose the correct account from the start. This helps avoid delays and ensures your payments continue without interruption.

Frequently Asked Questions (FAQs)

1. Can I use someone else’s bank account for my SASSA payments?

No. SASSA only allows payments to be made into a bank account registered in your own name. If you submit someone else’s account, your SASSA change banking details request will be rejected.

2. How long does it take for SASSA to update my banking details?

It usually takes 7 to 10 working days for your new banking details to be verified and updated. You will receive an SMS notification once the change is successful.

3. Can I still change my banking details if I don’t have internet access?

Yes. You can visit your nearest SASSA office or Post Office and request to change your banking details in person. Bring your ID, proof of bank account, and mobile phone.

4. What should I do if I changed my cellphone number?

If your phone number has changed, update it first through the SASSA SRD website or by visiting a SASSA office. You need access to your phone number to receive the secure SMS link for the SASSA change banking details process.

5. What type of proof do I need for my bank account?

You must submit either a:

- Bank statement (not older than 3 months), or

- Bank confirmation letter that clearly shows your name, account number, and branch code.

6. Is it safe to change my banking details online?

Yes, as long as you use the official SASSA SRD website: https://srd.sassa.gov.za. Never share your personal or banking info with anyone claiming to help you outside of official channels.

7. What happens if I enter the wrong account number?

If the account number doesn’t match your name or is incorrect, your SASSA change banking details request will fail. Double-check everything before submitting.

8. Can I change my banking details if I’m receiving the Older Person, Disability, or Child Support Grant?

Yes. The same process applies for all SASSA grants. Make sure to use your own bank account and valid documents when submitting your request.

Final Tips for a Smooth Banking Change Process

Changing your banking details with SASSA is an important task that needs careful attention to avoid delays or complications. To ensure your SASSA change banking details process goes smoothly, keep these final tips in mind:

1. Double-Check All Your Information

Before submitting your new banking details, verify that your account number, branch code, and bank name are correct and match your official documents. Small errors can cause payment delays or rejections.

2. Use Your Own Bank Account

Make sure the bank account you provide is registered in your own name. Payments sent to someone else’s account will be rejected by SASSA.

3. Keep Your Mobile Number Updated

SASSA sends important SMS messages, including verification links and payment confirmations, to your phone. Ensure your mobile number is current and active to avoid missing critical updates.

4. Submit Recent Bank Proof Documents

Only submit a bank statement or bank confirmation letter that is not older than 3 months. Outdated documents are often rejected, delaying your banking details update.

5. Use the Official SASSA Website or Offices

Always use the official website (https://srd.sassa.gov.za) for online updates or visit official SASSA offices/post offices for in-person changes. Avoid third parties or unofficial sites to protect your personal information.

6. Be Patient During the Verification Process

After submitting your request, expect a wait time of 7 to 10 working days for verification and approval. Plan accordingly to avoid missing grant payments.

7. Avoid Multiple Changes in One Payment Cycle

Try to get your banking details right the first time. Changing your details multiple times within one payment cycle can cause delays or complications.

Conclusion

Keeping your banking details up to date with SASSA is essential to ensure your grant payments are received on time and without any issues. Whether you choose to update your information online or in person, following the correct steps and submitting accurate documents will make the SASSA change banking details process smooth and hassle-free.

Remember to always use official channels, double-check your information, and keep your mobile number active for verification messages. By staying informed and prepared, you can avoid delays and continue receiving your grant without interruption.

If you need to change your banking details, act promptly and carefully — your financial security depends on it.