Loans for SASSA beneficiaries offer much-needed financial assistance to many South Africans who rely on social grants. These types of loans form part of what is commonly referred to as SASSA Loans, a term used to describe credit options available to grant recipients. If you are a SASSA grant recipient looking to understand how these loans work, who offers them, and what you need to qualify, this guide will walk you through everything you need to know. From types of loans available to important tips and warnings, read on to make informed and safe borrowing decisions.

What Are Loans for SASSA Beneficiaries?

Loans for SASSA beneficiaries are a type of SASSA Loan, made available to individuals who receive grants from the South African Social Security Agency (SASSA). These loans are not offered by SASSA itself but by registered financial institutions or credit providers who accept SASSA grant income as proof of affordability.

Many beneficiaries rely on grants such as the Old Age Pension, Disability Grant, Child Support Grant, or the R350 SRD Grant to meet basic needs. When emergencies arise, or when unexpected expenses occur, loans for SASSA beneficiaries can provide short-term financial relief.

However, it’s important to note that these loans come with interest rates and repayment obligations, just like any other form of credit. Borrowers should carefully read the terms and understand how much they will repay in total before agreeing to a loan.

Who Can Apply?

If you receive one of the following SASSA grants, you may be eligible to apply for a loan:

- Old Age Grant

- Disability Grant

- Child Support Grant

- Foster Care Grant

- War Veteran’s Grant

- SRD R350 Grant (limited options)

Each lender may have its own criteria. Some may not accept the R350 SRD grant as sufficient income for loan approval.

How Do These Loans Work?

Loans for SASSA beneficiaries typically work like regular personal loans, but they are tailored to low-income individuals. Here’s how they usually function:

- Loan Amount: R500 to R10,000 (depending on the lender)

- Repayment Period: From 1 month to 24 months

- Repayment Method: Direct deduction from your bank account or SASSA card

- Interest Rates: Vary depending on lender and repayment period

Lenders assess your affordability based on your grant income and may also check your credit score if applicable.

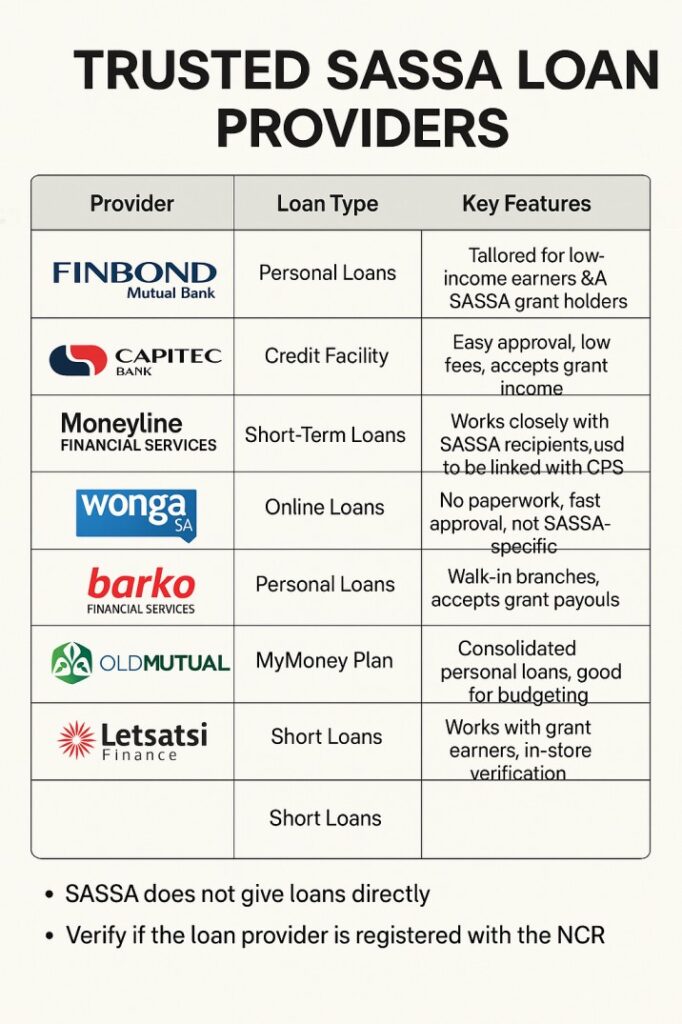

Who Offers Loans to SASSA Beneficiaries?

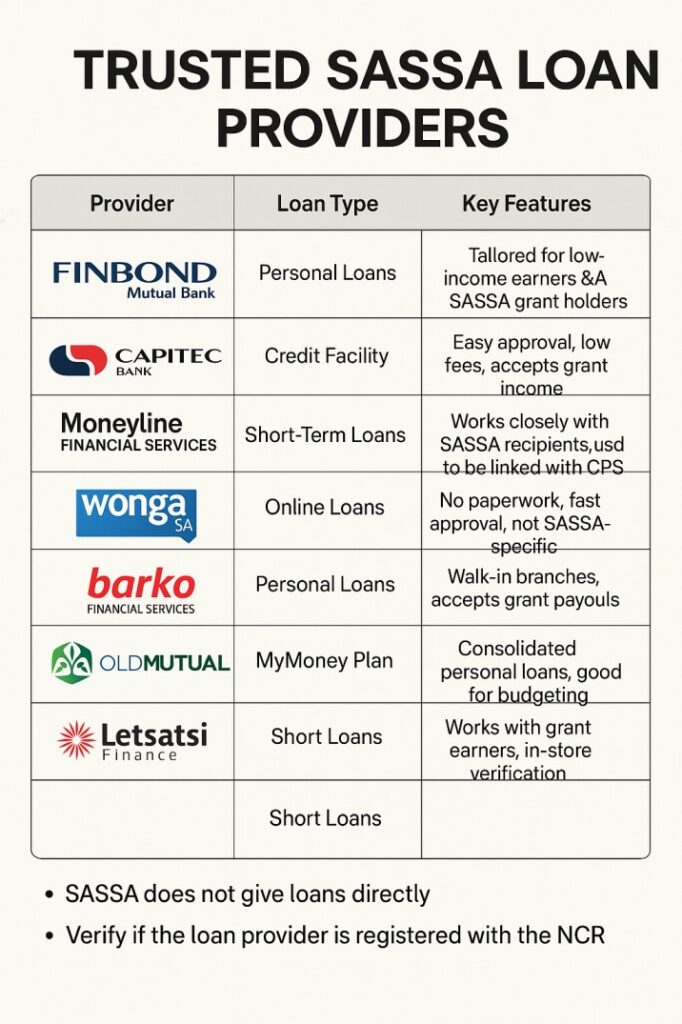

If you’re looking for loans for SASSA beneficiaries, it’s important to know where to apply safely and legally. While SASSA itself does not give out loans, many registered lenders and financial institutions in South Africa provide loan products tailored to people who receive SASSA grants.

These lenders recognize that many grant recipients may need access to short-term credit for emergencies, school fees, home repairs, or other needs.

Below are the main types of providers that offer these loans:

1. Banks

Some banks in South Africa offer personal loans to SASSA grant holders, especially if the beneficiary receives their grant into a bank account. Examples include:

- Capitec Bank: Offers flexible loans based on affordability.

- African Bank: Known to offer loans to low-income individuals, including some grant recipients.

However, not all banks approve loans purely based on grant income. A credit check and affordability assessment may still be required.

2. Microlenders and Credit Providers

There are many microfinance companies and NCR-registered lenders that specialize in small loans for low-income individuals, including SASSA beneficiaries. These lenders often offer:

- Short-term loans

- Emergency cash loans

- Quick online applications

- Same-day payouts

Before borrowing, ensure the lender is registered with the National Credit Regulator (NCR). This protects you from illegal loan sharks and helps ensure fair treatment.

3. Loan Apps and Online Platforms

With technology on the rise, several loan apps now offer convenient access to loans for SASSA beneficiaries. These platforms allow users to:

- Apply using a phone or computer

- Upload documents digitally

- Receive payouts within 24–48 hours

Some platforms may require access to your banking or SASSA card details to verify your income.

4. Caution: Illegal and Unregistered Lenders

Not all lenders operate legally. Some so-called “cash loan” services or informal lenders prey on vulnerable beneficiaries by:

- Charging extremely high interest

- Taking SASSA cards as collateral

- Forcing automatic monthly deductions

Always check that a lender is registered with the NCR (www.ncr.org.za) before applying for any loan.

Requirements to Qualify for a SASSA Loan

Before applying for loans for SASSA beneficiaries, it’s important to understand what documents and conditions you need to meet. While each lender may have slightly different requirements, most follow the same basic criteria to ensure that the borrower can repay the loan responsibly.

Here are the common requirements:

1. South African ID Document

You must have a valid green barcoded South African ID book or smart ID card. This is used to confirm your identity and legal status.

2. Proof of Receiving a SASSA Grant

You need to prove that you receive a SASSA social grant, such as:

- Old Age Pension

- Disability Grant

- Child Support Grant

- SRD R350 Grant (accepted by limited lenders)

This proof can come in the form of:

- A recent SASSA payment slip

- Your SASSA card with transaction history

- A bank statement showing grant deposits

3. Bank Statement or SASSA Card Transaction History

Lenders will often ask for your last 3 months’ bank statement if your grant is deposited into a bank account. If you use a SASSA card, they may ask for a printout of your transaction history to verify income and spending patterns.

4. Proof of Residence

Some lenders may ask for proof of where you live, such as a utility bill, municipal letter, or formal letter from a ward councilor.

5. Contact Details

You must provide a valid cell phone number where you can receive loan updates and OTP verifications. Some lenders also request an alternative contact person.

6. Affordability Assessment

To comply with South African lending laws, lenders will do an affordability check to ensure you can repay the loan without falling into debt. This may include:

- Looking at your income and expenses

- Running a basic credit check (optional for some lenders)

- Confirming your grant income is stable

Types of Loans Available for SASSA Recipients

When searching for loans for SASSA beneficiaries, it’s helpful to understand the different types of loans available. Various lenders offer loan products that suit the financial needs and repayment abilities of grant recipients. Here are the most common types of loans for SASSA recipients:

1. Short-Term Loans

Short-term loans are designed for quick access to small amounts of money, usually ranging from R500 to R5,000. These loans typically have repayment periods of 30 days up to 6 months.

They are ideal for emergency expenses such as medical bills, transport costs, or urgent household repairs. Interest rates on short-term loans tend to be higher, so it’s important to borrow only what you need and repay on time.

2. Personal Installment Loans

These loans allow you to borrow a larger amount, often between R3,000 and R10,000, and repay it over a longer period, usually 6 to 24 months.

Installment loans have fixed monthly repayments, which makes budgeting easier for beneficiaries. Interest rates are generally lower than short-term loans, but you should still compare different lenders to find the best deal.

3. Emergency Loans

Emergency loans are similar to short-term loans but specifically marketed for urgent financial needs. Some lenders provide fast approval and same-day payout to help beneficiaries cover unexpected costs.

4. Payday Loans

Payday loans are very short-term loans intended to be paid back on your next payday or SASSA grant payment date. These are usually small amounts with high interest and fees, so use them cautiously.

Important to Remember

Interest rates, fees, and loan amounts vary depending on the lender and your eligibility. Some lenders may limit loan amounts based on the size of your SASSA grant. Always check the loan agreement carefully before signing.

How to Apply for a Loan as a SASSA Beneficiary

Applying for loans for SASSA beneficiaries is a process designed to be straightforward, but it’s important to follow the right steps to improve your chances of approval and avoid scams. Here is a simple guide on how to apply safely and successfully:

1. Research and Compare Lenders

Start by identifying registered lenders who offer loans to SASSA grant recipients. Look for banks, microlenders, or loan apps that are registered with the National Credit Regulator (NCR). Compare:

- Loan amounts

- Interest rates

- Repayment terms

- Application requirements

2. Check Your Eligibility

Before applying, ensure you meet the lender’s criteria. This usually includes having a valid South African ID, receiving a SASSA grant, and providing proof of income.

3. Prepare Required Documents

Gather all necessary documents, including:

- South African ID

- Proof of SASSA grant (payment slip or card)

- Bank statements or transaction history

- Proof of residence

- Contact details

Having these ready will speed up the application process.

4. Submit Your Application

Many lenders allow you to apply online via their website or mobile app. Alternatively, you can visit a physical branch if available.

During application, you’ll need to fill out personal details and upload your documents. Make sure you provide accurate information to avoid delays.

5. Wait for Approval

After submitting your application, the lender will assess your affordability and creditworthiness. This process can take anywhere from a few minutes (for online apps) to a few days.

If approved, you will receive a loan agreement to review and sign. Read all terms carefully before accepting.

6. Receive Your Funds

Once you sign the agreement, the loan amount is usually deposited into your bank account or paid onto your SASSA card within 24 to 48 hours.

Tips for a Smooth Application

- Avoid applying to multiple lenders at once to protect your credit score.

- Always verify the lender’s NCR registration.

- Never pay upfront fees before receiving your loan.

- Keep copies of all communications and agreements.

Dangers and Scams to Watch Out For

While searching for loans for SASSA beneficiaries, it’s important to be aware of potential dangers and scams. Unfortunately, some illegal lenders target vulnerable grant recipients with unfair terms or fraudulent practices. Protecting yourself starts with knowing what to watch out for.

Common Loan Scams Targeting SASSA Beneficiaries

- Unregistered Lenders

Some loan providers operate without registration from the National Credit Regulator (NCR). These lenders may offer quick cash but charge extremely high interest rates and hidden fees. Always confirm a lender’s NCR registration before applying. - Upfront Fees

Legitimate lenders do not require payment before you receive your loan. Scammers often ask for “processing fees” or “insurance payments” upfront. Paying these fees does not guarantee a loan and often results in loss of money. - Loan Sharks and Illegal Cash Collectors

Some illegal lenders demand payments in cash and use threats or intimidation to collect debts. They may confiscate your SASSA card or unlawfully deduct payments. These practices are illegal and should be reported. - Fake Websites and Social Media Scams

Scammers create fake websites or social media pages posing as trustworthy lenders. They may lure applicants with promises of guaranteed approval. Always verify the official website and contact information.

How to Protect Yourself

- Verify lender registration on the official National Credit Regulator (NCR) website at www.ncr.org.za.

- Never pay any fees before receiving your loan.

- Avoid lenders who pressure you to apply quickly or share sensitive information.

- Report suspicious lenders to the NCR or the South African Police Service.

- Use only trusted banks, reputable microlenders, or loan apps.

Tips Before Taking a Loan on a SASSA Grant

Taking out loans for SASSA beneficiaries can provide much-needed financial relief, but it’s essential to proceed carefully. Borrowing money is a serious decision, and understanding the key tips below will help you avoid unnecessary debt and financial stress.

1. Assess If You Really Need the Loan

Before applying, ask yourself if the loan is absolutely necessary. Can you cover the expense through budgeting, support from family, or community resources? Loans come with interest and fees, so borrowing only when necessary reduces financial pressure.

2. Borrow Only What You Can Afford to Repay

Calculate your monthly expenses and income carefully. Choose a loan amount and repayment plan that fits your budget. Missing repayments can lead to penalties, increased debt, and negatively affect your credit score.

3. Compare Loan Offers

Don’t settle for the first loan you find. Compare interest rates, fees, repayment terms, and loan amounts from different lenders offering loans for SASSA beneficiaries. This helps you find the most affordable and suitable option.

4. Understand the Loan Terms

Read the loan agreement thoroughly before signing. Pay attention to:

- Interest rates and fees

- Repayment schedule and methods

- Penalties for late or missed payments

- Total cost of the loan over its lifetime

If anything is unclear, ask the lender to explain.

5. Have a Repayment Plan

Plan how you will make repayments on time, preferably from your grant income or other stable sources. Setting reminders or using automatic debit orders can help you avoid missing payments.

6. Explore Alternatives First

If possible, consider alternatives to loans such as:

- Community savings groups

- Budgeting and cutting non-essential expenses

- Seeking financial advice or social services support

FAQs About Loans for SASSA Beneficiaries

Here are answers to some of the most common questions about loans for SASSA beneficiaries to help you make informed decisions.

1. Can I get a loan if I only receive the R350 SRD grant?

Yes, some lenders offer loans to beneficiaries of the SRD R350 grant. However, many lenders consider this grant a limited income source and may offer smaller loan amounts or require additional proof of affordability.

2. Is it safe to apply for a loan online as a SASSA beneficiary?

Applying online is safe as long as you use registered and reputable lenders. Always verify the lender’s registration with the National Credit Regulator (NCR) and avoid sharing personal information with unknown or suspicious sites.

3. What happens if I miss a loan repayment?

Missing repayments can lead to late fees, increased interest, and negative impacts on your credit record. It may also result in debt collectors contacting you. It’s important to communicate with your lender if you experience payment difficulties.

4. Can I apply for a loan if I have a poor credit history?

Some microlenders may offer loans to individuals with poor credit, but interest rates might be higher. It’s best to check with each lender’s policies and consider alternatives before borrowing.

5. How long does the loan approval process take?

Loan approval times vary. Some online loan apps provide instant or same-day approval, while traditional lenders might take a few days to process your application.

6. Are there any hidden fees in loans for SASSA beneficiaries?

Legitimate lenders disclose all fees upfront in the loan agreement. Always read the terms carefully and ask questions if fees are unclear.

Conclusion

Finding the right loans for SASSA beneficiaries can provide valuable financial support when unexpected expenses arise. However, it is essential to borrow responsibly by understanding the types of loans available, meeting the necessary requirements, and choosing reputable, registered lenders. Always be cautious of scams and read loan agreements carefully before committing.

By following the tips shared in this guide and doing thorough research, SASSA grant recipients can access loans that meet their needs without falling into debt traps. Remember, borrowing should be a last resort after exploring other financial options.

Take control of your finances by making informed decisions and protecting yourself throughout the loan process.