SASSA Loans have become a popular option for many South Africans who rely on social grants and need quick access to extra cash. Although SASSA itself does not provide loans, several trusted lenders offer financial assistance to grant recipients. In this blog post, we’ll explain what SASSA Loans are, who qualifies, how to apply safely, and what you need to know before borrowing.

What Are SASSA Loans?

SASSA Loans are financial loan products offered by private lenders specifically to individuals who receive social grants through the South African Social Security Agency (SASSA). While the term might suggest that SASSA itself provides loans, the truth is that SASSA does not give out loans. Instead, private financial institutions partner with SASSA cardholders to offer small to medium-sized loans, often deducted directly from their monthly grant payments.

These loans are designed to provide short-term financial relief for emergencies, unexpected expenses, or day-to-day needs. They are usually repaid monthly over a short period, and repayment is often made directly from your SASSA card to the lender, making it easier for recipients to manage the debt.

Important: If anyone claims that SASSA directly offers loans, they are likely misleading you. All legitimate SASSA-related loans are provided by third-party financial services that work with SASSA cardholders—not by SASSA itself.

Why the Term “SASSA Loans” Is Common

Many people use the phrase “SASSA Loans” because these loans are tied to SASSA grants. For example, if you receive a Child Support Grant, Old Age Pension, or Disability Grant, some loan companies may allow you to apply for a loan using proof of this grant as a source of income.

These loans are typically advertised as:

- EasyPay Loans

- Personal Loans for SASSA Cardholders

- Loans for SASSA Beneficiaries

Common Misunderstanding

There is often confusion between SASSA and loan providers because some lenders operate inside retail stores like Shoprite, Boxer, and Pick n Pay, which are also grant payout points. This makes it seem like the loans come from SASSA, but they do not.

Who Qualifies for SASSA Loans?

Not everyone can apply for SASSA Loans. These loans are specifically targeted at people who receive monthly social grants through the South African Social Security Agency (SASSA). Loan providers use your grant as a form of income to assess whether you can repay the loan.

Here’s a clear breakdown of who qualifies for SASSA Loans:

1. You Must Be a SASSA Grant Recipient

To apply for SASSA Loans, you must receive a qualifying SASSA grant. These may include:

- Old Age Grant

- Disability Grant

- Child Support Grant

- Foster Child Grant

- Care Dependency Grant

- War Veteran’s Grant

Your grant acts as proof of income and helps the lender determine your loan eligibility.

2. You Must Be 18 Years or Older

Applicants must be at least 18 years old. You should also have a valid South African ID and be capable of entering into a loan agreement legally.

3. You Must Have a SASSA Card or Grant Account

SASSA Loans are typically linked to your SASSA card, which is where your monthly grant is paid. Lenders use this account to debit repayments automatically.

Some lenders may require that you have your grant paid into a bank account rather than the SASSA card, depending on their policies.

4. You Must Show Ability to Repay the Loan

Although SASSA Loans are offered to low-income individuals, you must still prove that you can afford the loan. Most lenders will:

- Check your monthly income vs. expenses

- Avoid lending to someone who is already over-indebted

- Perform credit checks in some cases

5. You Must Apply Through Approved Lenders

Only approved financial service providers working with SASSA cardholders can offer loans. Avoid anyone offering “SASSA Loans” through WhatsApp, social media, or SMS without proof of legitimacy.

Types of Loans Available for SASSA Beneficiaries

There are several types of SASSA Loans designed to meet different needs. These loans are offered by private lenders to SASSA grant recipients and are often short-term with manageable repayment terms. Below are the most common loan options available to SASSA beneficiaries:

1. Personal Loans

Personal loans are the most common form of SASSA Loans. These are cash loans offered to grant holders, often based on their monthly grant income. You can use the money for anything — from school fees and home repairs to groceries or emergencies.

- Loan amounts usually range from R250 to R5,000 or more

- Repayment terms range from 1 to 6 months

- Monthly repayments are automatically deducted from your SASSA card

These loans are typically offered by providers like EasyPay, Finbond, and Moneyline.

2. Emergency Loans

Emergency loans are small, fast-access loans meant to help during a financial crisis. These are ideal for unexpected situations such as medical bills, funerals, or urgent household needs.

- Often disbursed quickly, sometimes within 24 hours

- Lower loan amounts, usually under R2,000

- Shorter repayment period

Not all lenders offer this option, so it’s important to check availability with the loan provider.

3. Short-Term Loans

Short-term loans are similar to personal loans but typically come with a very short repayment period, such as 1 to 3 months. They’re meant for people who want to borrow a small amount and repay it quickly.

- Ideal for temporary cash flow issues

- Interest may be higher due to shorter terms

- Still requires proof of a stable SASSA grant income

4. Loans with Fixed Monthly Deductions

Some SASSA Loans are structured with fixed monthly repayments, which are deducted automatically from your SASSA grant. This setup makes it easier for grant recipients to manage their finances because the repayment amount does not change each month.

- Fixed monthly payment deducted from SASSA card

- No need to visit the loan provider to pay manually

- Helps avoid missed payments or penalties

5. Loans Through Retail Partners

Certain retail stores like Shoprite, Boxer, and Pick n Pay offer loan services through licensed financial partners. These loans are often marketed at the tills or service desks and may be directly linked to your SASSA grant.

- Convenient for people who collect grants at these stores

- Offered through formal financial service providers inside the store

How to Apply for SASSA Loans in 2025

Applying for SASSA Loans in 2025 is a simple process, but it’s important to follow the right steps and use only trusted loan providers. Since SASSA itself doesn’t issue loans, applications are made through licensed financial service providers that work with SASSA beneficiaries.

Here’s a step-by-step guide on how to apply:

Step 1: Make Sure You Qualify

Before applying, ensure that you:

- Receive a valid SASSA grant (e.g. Old Age, Child Support, Disability)

- Have a SASSA card or bank account where the grant is deposited

- Are 18 years or older

- Can afford to repay the loan from your monthly grant income

It’s always a good idea to check your latest grant status and balance before applying.

Step 2: Choose a Trusted Loan Provider

You should only apply through reputable and registered lenders. These include:

- EasyPay Loans

- Moneyline (linked to Net1 and SASSA cards)

- Finbond Microfinance

- Retail partners like Shoprite, Boxer, and Pick n Pay (with financial service desks)

Avoid anyone offering SASSA Loans via WhatsApp, social media, or street flyers, as these are often scams.

Step 3: Gather Required Documents

When applying for SASSA Loans, you will usually need the following:

- A valid South African ID

- Your SASSA card

- Recent SASSA grant payment slips or proof of payment

- Bank statements (if your grant is deposited into a bank account)

- Contact details (phone number and address)

Some lenders may ask for affordability assessments to make sure you can repay the loan.

Step 4: Submit Your Application

There are two main ways to apply:

A. In-Store Application

- Visit a loan provider’s physical branch or a retail partner like Shoprite

- Complete the loan application form

- Present your documents and wait for approval

B. Online or Mobile Application

- Visit the lender’s official website

- Fill out the digital application form

- Upload documents or verify details via a secure platform

- Wait for confirmation by SMS or email

Online applications are becoming more common and convenient in 2025, but always double-check that the site is secure and official.

Step 5: Approval and Payout

If your application is approved:

- The loan amount is paid directly into your SASSA card or bank account

- Monthly repayments will be deducted automatically from your grant

Make sure to read the terms and conditions carefully before accepting any loan.

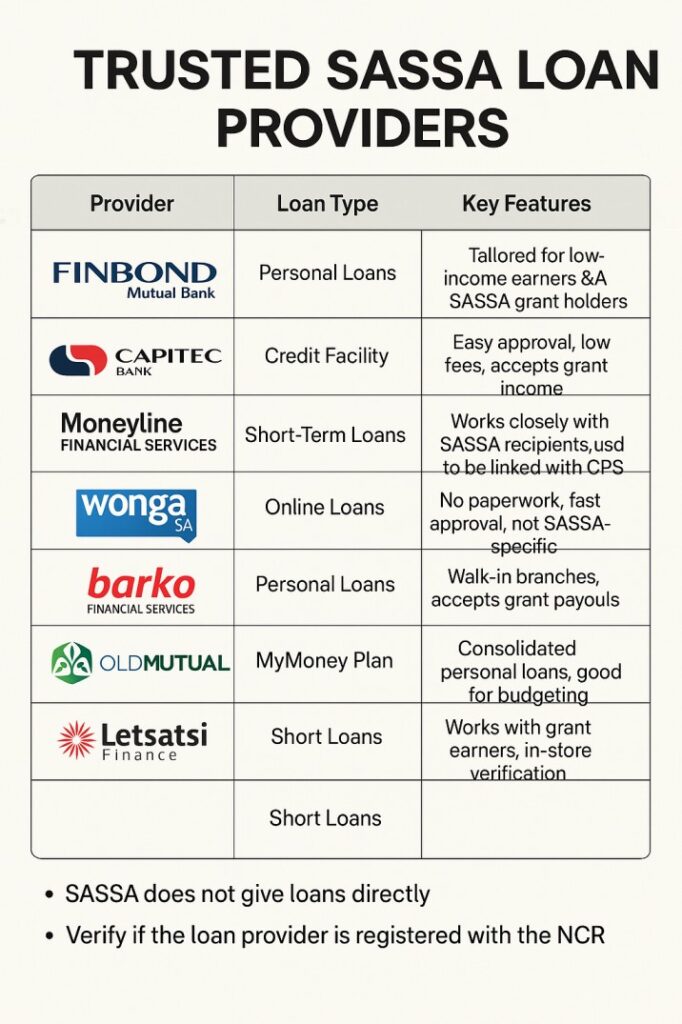

Trusted Loan Providers for SASSA Beneficiaries

If you’re a grant recipient looking for SASSA Loans, it’s important to work only with trusted and approved lenders. These providers are licensed to offer loans to SASSA beneficiaries and follow the rules set by the National Credit Regulator (NCR).

Here are the most recognized and reliable loan providers for SASSA grant holders in South Africa:

1. EasyPay Loans

EasyPay Loans is one of the most popular choices for SASSA beneficiaries. In fact, EasyPay SASSA Loans are among the most frequently accessed financial products by grant recipients, thanks to their convenience and availability at major retailers.. They offer short-term personal loans with repayments deducted directly from your SASSA card.

- Loan amounts typically range from R250 to R5,000+

- Repayments are taken from your monthly grant

- Applications can be done in-store or online

Tip: EasyPay Loans are often available at retailers like Shoprite and Boxer.

2. Moneyline Financial Services

Moneyline is a subsidiary of Net1 and has worked with the SASSA payment system in the past. They offer small loans to qualifying grant holders using the grant as income verification.

- Loans are linked to your SASSA card account

- Monthly repayments are automated

- Known for easy application process and fast payouts

Note: Always verify that Moneyline is still operating in your region, as services may vary.

3. Finbond Microfinance

Finbond is a registered financial service provider that offers loans to SASSA recipients through retail outlets and branches nationwide.

- Offers both short-term and personal loans

- Credit checks and affordability assessments are done

- Competitive interest rates and flexible repayment terms

Applications are typically done in-person at a Finbond branch or participating stores.

4. Retail Store Partners (Shoprite, Pick n Pay, Boxer)

Some of South Africa’s largest retail chains act as loan agents for approved microfinance lenders. These stores don’t issue the loans themselves but offer in-store desks where you can apply.

- Shoprite, Boxer, and Pick n Pay are common partners

- Application desks available during business hours

- Perfect for those collecting grants in-store

Make sure the lender in the store is registered with the NCR and provides a written loan agreement.

How to Know if a Loan Provider Is Legitimate

Before applying for any SASSA Loans, check the following:

- The lender must be registered with the National Credit Regulator (NCR)

- They must provide a loan agreement with clear terms

- No upfront payment should be required

- The business must have verifiable contact details and a physical address

Benefits and Risks of Taking a SASSA Loan

While SASSA Loans can be helpful in times of financial need, they also come with potential risks. It’s important to understand both the advantages and disadvantages before applying. Borrowing money should be a carefully considered decision — especially if you rely on a fixed grant income each month.

Benefits of SASSA Loans

1. Access to Quick Cash

SASSA Loans can help you cover urgent expenses like medical bills, funeral costs, or school fees without delay. Some lenders pay out within 24 hours after approval.

2. No Formal Employment Required

Unlike traditional loans, SASSA Loans are based on your grant income. You don’t need a salary or payslip to qualify, making them accessible to unemployed individuals.

3. Easy Application Process

Many providers allow simple applications with minimal paperwork. Some even offer online or mobile applications, saving time and travel.

4. Fixed Monthly Deductions

Repayments are automatically deducted from your SASSA grant, which means you don’t have to worry about missing a payment manually.

5. Available at Trusted Retailers

You can apply at stores where you already collect your grant — like Shoprite, Boxer, or Pick n Pay — making access to loans more convenient.

Risks of SASSA Loans

1. High Interest Rates

SASSA Loans often come with higher interest rates compared to regular bank loans. Over time, this could lead to paying back much more than you borrowed.

2. Over-Indebtedness

It’s easy to fall into debt if you borrow more than you can afford to repay. A loan might cover short-term needs but create long-term problems if not managed wisely.

3. Monthly Deduction Reduces Your Grant

Since repayments come straight from your grant, you will receive less money each month. This could impact your ability to afford daily expenses.

4. Risk of Loan Scams

Many scammers target SASSA beneficiaries with fake loan offers. Applying through unregistered lenders can lead to identity theft or financial loss.

5. Limited Loan Amounts

Because these loans are tied to small monthly grants, you might not qualify for large sums of money — even if your need is urgent.

Be a Responsible Borrower

Before taking out a SASSA Loan, ask yourself:

- Do I really need this loan?

- Can I survive on a smaller grant after deductions?

- Am I dealing with a registered and trustworthy lender?

Taking a loan should be a last resort, not a regular solution. Make sure you fully understand the terms before signing any agreement.

How to Protect Yourself from Loan Scams

As the demand for SASSA Loans grows, so does the number of fake lenders and scams targeting vulnerable SASSA grant recipients. These scams often appear convincing and promise fast, easy cash — but their goal is to steal your personal information or money.

To stay safe, it’s important to know the warning signs and follow smart steps before applying for any loan.

1. Never Pay Upfront Fees

Legitimate SASSA loan providers will never ask you to pay a fee before approving your loan. Scammers often demand an upfront payment for “processing,” “insurance,” or “fast-track” services — then disappear.

Tip: If someone asks for money before you get the loan, it’s a scam.

2. Only Deal With Registered Lenders

Make sure the company is registered with the National Credit Regulator (NCR). Every legal credit provider in South Africa must have an NCR number, which you can verify on the NCR website.

Ask the lender:

- What is your NCR registration number?

- Do you have a physical office?

- Can I see a copy of the loan agreement?

3. Avoid WhatsApp and Social Media Loan Offers

Scammers often advertise fake SASSA Loans through:

- WhatsApp messages

- Facebook pages

- TikTok videos

- SMS links

These platforms are not safe places to apply for loans unless they direct you to an official, verified lender’s website.

4. Don’t Share Your SASSA Card or PIN

Never give your SASSA card or PIN to anyone, even if they claim to be helping you apply for a loan. Your card and PIN are private — sharing them could allow someone to withdraw your entire grant without your permission.

5. Look for Clear Loan Terms

Legitimate lenders will provide:

- A clear loan agreement

- Interest rate and total repayment amount

- Monthly deduction breakdown

- Your right to cancel within a certain period

If someone avoids giving you this information or pressures you to sign quickly, walk away.

6. Report Suspicious Activity

If you suspect a loan scam or feel unsafe:

- Contact the National Credit Regulator (NCR) at 0860 627 627

- Report scams to the South African Police Service (SAPS)

- Warn other grant recipients in your community

FAQs about SASSA Loans

Here are some of the most frequently asked questions about SASSA Loans to help you understand the basics and clear up common doubts.

1. Can I get a loan with just a SASSA card?

Yes, many lenders offer SASSA Loans specifically for grant recipients who have a valid SASSA card. The loan repayments are usually deducted directly from your grant payments, making it easier to manage.

2. How much can I borrow with a SASSA Loan?

Loan amounts vary by lender but typically range between R250 and R5,000. The exact amount you qualify for depends on your monthly grant and your ability to repay.

3. How long does it take to get approved for a SASSA Loan?

Approval times differ, but many providers offer fast approvals within 24 to 48 hours, especially if you apply online or in-store with all your documents ready.

4. Will taking a SASSA Loan affect my monthly grant?

The loan repayment is deducted from your monthly grant, which means you will receive less money each month. It’s important to budget carefully to avoid financial strain.

5. Does SASSA itself provide loans?

No, SASSA does not provide loans directly. All SASSA Loans come from private lenders who work with SASSA grant recipients.

6. Are SASSA Loans safe?

SASSA Loans from registered and approved lenders are safe. However, be cautious of scams and unregistered lenders. Always verify the lender’s credentials before applying.

7. Can I apply for a SASSA Loan online?

Yes, many lenders now offer online applications for convenience. Just make sure you use the official website or authorized loan providers.

Conclusion

SASSA Loans can provide much-needed financial support for grant recipients facing unexpected expenses or emergencies. While these loans offer quick access to cash without formal employment requirements, it’s essential to borrow responsibly and only from trusted, registered lenders.

Remember, SASSA itself does not issue loans — all loans linked to SASSA grants come from private financial service providers. Before applying, make sure you fully understand the terms, repayment process, and how the loan deductions will affect your monthly grant.

By staying informed and cautious, you can use SASSA Loans as a helpful financial tool while protecting yourself from scams and over-indebtedness.

If you found this guide useful, feel free to share it with others or leave your questions in the comments below.